See below for our explanation in detail

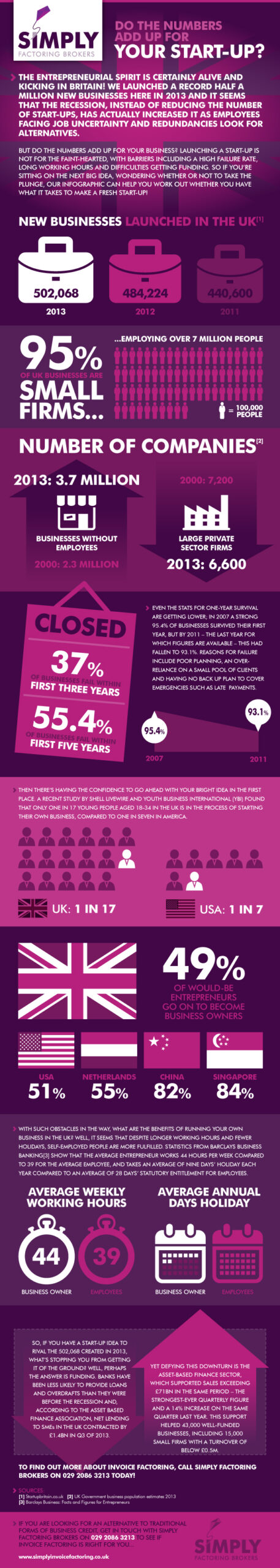

The entrepreneurial spirit is certainly alive and kicking in Britain! We launched a record half a million new businesses here in 2013 and it seems that the recession, instead of reducing the number of start-ups, has actually increased it as employees facing job uncertainty and redundancies look for alternatives.

But do the numbers add up for your business? Launching a start-up is not for the faint-hearted, with barriers including a high failure rate, long working hours and difficulties getting funding. So if you’re sitting on the Next Big Idea, wondering whether or not to take the plunge, our infographic can help you work out whether you have what it takes to make a fresh start-up!

A total of 502,068 new businesses launched in the UK in 2013[1], comfortably passing 2012’s 484,224 new start-ups and smashing the 440,600 created in 2011. According to Startupbritain.co, start-ups and small firms account for 95% of business in Britain and employ seven million people. Government figures show that businesses without employees rose by 56% between 2000 and 2013, from 2.4m to 3.7m, whilst during the same period the number of large private sector firms fell from 7,200 to 6,600[2].

But despite the best intentions, making a success of a new business can be hard. The Office for National Statistics’ business demographic 2012 shows that 37% of businesses fail in the first three years and 55.4% fail within five. Even the stats for one-year survival are getting lower; in 2007 a strong 95.4% of businesses survived their first year, but by 2011 – the last year for which figures are available – this had fallen to 93.1%. Reasons for failure include poor planning, an over-reliance on a small pool of clients and having no back up plan to cover emergencies such as late payments.

Then there’s having the confidence to go ahead with your bright idea in the first place. A recent study by Shell LiveWIRE and Youth Business International (YBI) found that only one in 17 young people aged 18-34 in the UK is in the process of starting their own business, compared to one in seven in America. And the UK has a relatively low conversion rate amongst young people who do have a business idea, with less than half – 49% – of would-be entrepreneurs going on to become business owners who don’t pay a salary. In comparison, this number is 51% in the US, 55% in the Netherlands and a staggering 82% in China and 84% in Singapore.

With such obstacles in the way, what are the benefits of running your own business in the UK? Well, it seems that despite longer working hours and fewer holidays, self-employed people are more fulfilled. Statistics from Barclays Business Banking[3] show that the average entrepreneur works 44 hours per week compared to 39 for the average employee, and takes an average of nine days’ holiday each year compared to an average of 28 days’ statutory entitlement for employees. In addition, only 30% are better off and 63% are busier – yet 81% of entrepreneurs are happier and 54% are more optimistic about their future than those in employment.

So, if you have a start-up idea to rival the 502,068 created in 2013, what’s stopping you from getting it of the ground? Well, perhaps the answer is funding. Banks have been less likely to provide loans and overdrafts than they were before the recession and, according to the Asset Based Finance Association, net lending to SMEs in the UK contracted by £1.4bn in Q3 of 2013. Yet defying this downturn is the asset-based finance sector, which supported sales exceeding £71bn in the same period – the strongest-ever quarterly figure and a 14% increase on the same quarter last year. This support helped 43,000 well-funded businesses, including 15,000 small firms with a turnover of below £0.5m. To find out more about invoice factoring, call Simply Factoring Brokers on 0333 772 1558 today!

[1] Startupbritain.co

[2] UK Government business population estimates 2013

[3] Barclays Business: Facts and Figures for Entrepreneurs