What Is Invoice Finance and Why Your Business Needs It

Invoice Finance funds businesses powerfully. It does help them to unlock cash from invoices that do remain unpaid. Instead of waiting 30, 60, or 90 days for payment, you can access almost immediately up to 90% of the invoice value. For growth, companies seeking consistent working capital or struggling with cash flow will find this a game-changer.

We at Simply Factoring Brokers specialize in connecting businesses with invoice finance providers that are right. Whether you’re a start-up, SME, or large enterprise, we match you with a solution tailored to your industry and financial goals. If businesses are dealing with late payments, Invoice Finance is a lifeline. Invoice Finance is also helpful here because seasonal income changes.

By financing invoices inside our network, companies control their finances, so reinvest in their operations feel reduced payment delay pressure. This exceeds a basic function. It represents calculated thinking.

Why Choose Simply Factoring Brokers for Your Invoice Finance Needs

Tailored Matching for Your Business

Simply Factoring Brokers carefully evaluates funding requirements, sector, plus business size. Through this, factoring companies that are offering terms aligned with your cash flow needs and growth goals can be matched with you.

Genuinely Independent Advice

We don’t depend on any single source. Therefore, you receive guidance without bias always. We aim to help you find the most flexible along with competitive invoice finance deal on the market.

Quick Access to Funds

Businesses need working capital. Speed is of importance for them though. Our procedure seeks to provide up to 90% of your invoice value usually with little paperwork, in 24 to 48 hours.

Options for International Trade

We offer up international invoice factoring solutions for all exporters or for firms that do operate globally. These ensure steady cash flow for helping manage foreign transactions smoothly despite overseas payment terms.

The Role of Factoring Companies in Your Cash Flow Strategy

Factoring companies are the financial institutions that do purchase your outstanding invoices at a discount so they can provide you with upfront cash. The factoring company then receives payments from your customers when they are due.

- Factoring firms aid by changing outstanding bills to quick money.

- Reliance on bank loans or long payment terms is reduced through them.

- They manage collections. This action saves admin effort plus time.

- Businesses facing seasonal cash gaps as well as rapid growth may be ideal ones.

- Simply Factoring Brokers matches you up to the best-fit factoring partner.

Exploring International Invoice Factoring for Global Business Operations

For businesses trading overseas, differing credit standards, international payment delays, and foreign exchange fluctuations create unique financial challenges. These problems are solved by way of international invoice factoring via the management of collections across borders. It advances funds also against invoices abroad.

Simply Factoring Brokers specialises in connection for exporters located in the UK. We offer international factoring solutions to them. Healthy cash flow is maintained since this then enables businesses to trade confidently with overseas customers.

For companies, international invoice factoring benefits them particularly if they expand into new markets or if they rapidly grow in global sales. Businesses are able to reduce credit risk, maintain liquidity, and smoothly manage cross-border transactions with the support that our international factoring partners provide.

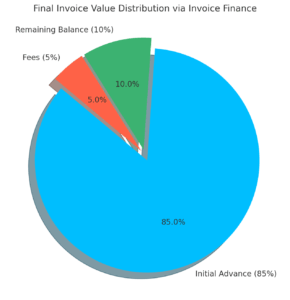

Final Invoice Value Distribution via Invoice Finance

- 85% Initial Advance: Cash received upfront after invoicing.

- 10% Remaining Balance: Paid once your customer settles the invoice.

- 5% Fees: Deducted by the factoring company for their services.

Quickly unlock working capital without waiting for full payment.

Fast, Simple, and Secure: Embracing Online Factoring Solutions

The table below compares key features of online factoring with traditional finance methods:

| Feature | Online Factoring | Traditional Business Loans |

| Speed of Approval | 24–48 hours | 1–3 weeks |

| Paperwork Required | Minimal – often fully digital | Extensive documentation |

| Collateral Needed | No – invoices serve as security | Often requires assets or credit history |

| Flexibility | Scale funding with invoice volume | Fixed amount regardless of invoice flow |

| Credit Impact | Based on your customer’s credit, not yours | Business and personal credit may be assessed |

| Ongoing Access to Funds | Continuous access as new invoices are issued | Lump sum loan with fixed repayment schedule |

Get Started with Invoice Finance Today

Because of how you battle with cash flow and look to expand or you just want even more financial flexibility, invoice finance offers up a solution that is reliable and much planned. Simply Factoring Brokers makes adventuring through factoring much easier. Facing this adventure alone is unnecessary.

We explain each funding choice and give assurance, from firms factoring and worldwide invoice factoring to online factoring which cuts edges. We approach hands-on meaning your business still controls accessing funds at times when you most need them.