Are you tired of waiting weeks, or even months, to get paid for your hard work? If cash flow issues are holding your business back, it might be time to explore a solution that has transformed the financial landscape for countless entrepreneurs: invoice factoring. This innovative financing option helps companies maintain steady cash flow and allows them to focus on growth and operations without the stress of unpaid invoices looming overhead.

Whether you’re a small startup or an established company, understanding how invoice factoring works could revolutionize your financial management approach. Let’s dive into this game-changing strategy and see how it can benefit your business.

Understanding Invoice Factoring

Invoice factoring is a financial strategy that allows businesses to improve cash flow. It involves selling outstanding invoices to a third party, known as a factor. This process enables companies to receive immediate funds instead of waiting for customers to pay their bills.

When you factor in an invoice, the factor provides a percentage of the total amount upfront. Typically, this can range from 70% to 90%. The remaining balance is held until the customer pays the invoice in full.

This method helps alleviate cash flow issues without incurring debt. Many small and medium-sized enterprises use it to finance growth or manage day-to-day expenses.

Understanding this concept opens new opportunities for business owners seeking flexible financial solutions. It’s crucial for entrepreneurs who want more control over their revenue cycle and operational stability.

How Does Invoice Factoring Work?

Invoice factoring is a straightforward process that allows businesses to convert outstanding invoices into immediate cash. Here’s how it works.

When your company provides goods or services, you send an invoice to your client with payment terms typically ranging from 30 to 90 days. Instead of waiting for the payment, you can sell this invoice to a factoring company at a discount.

The factoring company pays you a significant percentage of the invoice upfront, usually around 70% to 90%. They then take on the responsibility of collecting payments from your clients.

Once your client settles the invoice, the factor releases the remaining balance minus their fee. This means you get quick access to funds without straining customer relationships over late payments.

This influx of cash can be reinvested into operations or cover urgent expenses, creating more room for growth in your business strategy.

Benefits

Invoice factoring offers immediate access to cash, allowing businesses to bridge the gap between invoicing clients and receiving payments. This influx of capital can be crucial for managing everyday expenses or seizing new growth opportunities.

It also reduces the stress of chasing down overdue invoices. Instead of spending valuable time on collection efforts, companies can focus on their core operations while leaving the credit management to experts.

Moreover, invoice factoring improves cash flow predictability. Businesses gain a clearer view of their financial health when they know when funds will arrive.

Another significant advantage is that it doesn’t add debt to your balance sheet. Unlike loans, which require repayment with interest, factoring is based solely on receivables you already own.

What to Look for in an Invoice Factoring Company?

When choosing an invoice factoring company, start by assessing its reputation. Look for firms with positive reviews and strong testimonials from other businesses. A trustworthy provider will have a proven track record of reliability.

Next, consider the fees involved. Different companies have various pricing structures, so it’s vital to understand how much you’ll pay for their services. Transparency in pricing helps avoid unexpected charges later on.

Evaluate their customer service as well. You want a responsive partner who is ready to help or provide information.

Additionally, please review their terms and conditions carefully. Some companies may impose lengthy contracts that could limit your flexibility in the future.

Check the funding speed they offer. Quick access to cash can make all the difference when managing day-to-day operations or unexpected expenses.

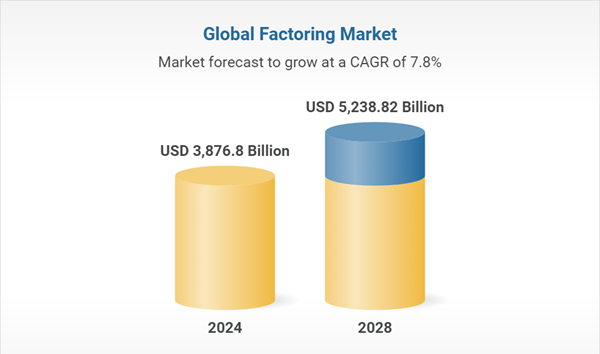

Global Factoring Market Forecast to grow 2024 to 2028

The Global Factoring Market is poised for substantial growth between 2024 and 2028, driven by a burgeoning demand for Invoice Factoring Services across various industries. As businesses grapple with cash flow challenges in an increasingly dynamic economic environment, the need for innovative financing solutions has become more pronounced.

Invoice factoring services provide companies with immediate access to working capital by converting their outstanding invoices into instant liquidity, enabling them to meet operational expenses and invest in new opportunities without delay.

The surge in e-commerce and the globalization of supply chains are expanding the customer base for these services, making it essential for providers to enhance their offerings through technology-driven platforms that guarantee efficiency and transparency.

Moreover, small to medium-sized enterprises (SMEs) are expected to contribute significantly to this market growth as they seek flexible financial alternatives beyond traditional bank loans. Emphasizing tailored solutions that cater specifically to niche markets will further bolster the competitiveness of key players as they navigate this evolving landscape over the next few years.

Conclusion: Why It Could Be the Key to Financial Success for Your Business

Navigating the financial landscape of running a business can take time and effort, especially when cash flow becomes tight. Invoice factoring offers a flexible and efficient solution to this common problem. You can stabilize your finances and invest in growth opportunities without delay by converting your outstanding invoices into immediate cash.

This funding method improves liquidity and allows for better management of operational costs and unexpected expenses. When you choose the right invoice factoring company, you can find tailored services that suit your specific needs, ensuring that you remain competitive in today’s fast-paced market.

For businesses looking to enhance their financial health and streamline operations, embracing invoice factoring could unlock new avenues for success. Understanding its mechanics empowers organizations to make informed decisions about financing options while improving overall business resilience.