Cash flow often feels like a rollercoaster ride in the fast-paced business world. One month, you’re riding high with client payments rolling in, and the next, you’re left wondering how to manage expenses while waiting for invoices to be settled.

This is where invoice factoring services come into play. They offer a lifeline for businesses looking to maintain steady cash flow without getting bogged down by unpaid invoices.

Imagine having immediate access to funds that allow you to invest in growth opportunities, cover payroll, or pay suppliers right on time. Curious about how this works?

Let’s dive into the transformative potential of invoice factoring services and discover if they might be what your business needs!

Understanding Invoice Factoring

Invoice factoring is a financial solution that allows businesses to convert their unpaid invoices into immediate cash. Instead of waiting for clients to pay, companies sell these invoices to a factoring company at a discount. This process streamlines cash flow and provides instant liquidity.

The concept dates back centuries but has gained traction as more businesses recognize its benefits. Companies across industries, from small start-ups to established enterprises, leverage this service.

Unlike traditional loans, invoice factoring doesn’t require collateral or lengthy approval processes. Instead, it focuses on the strength of your receivables rather than your credit history.

This flexibility makes it an appealing option for businesses looking to maintain operations during slow periods or invest in new opportunities without delay. Understanding this process can empower business owners to make informed decisions about managing their finances effectively.

The Benefits of Using Invoice Factoring Services

Invoice factoring services offer a lifeline for businesses facing cash flow challenges. By selling unpaid invoices, companies can access immediate funds. This quick turnaround is crucial for meeting payroll or purchasing inventory.

Another significant advantage is the reduced administrative burden. Traditional collections can be time-consuming and stressful. Factoring allows businesses to focus on growth rather than chasing payments.

Moreover, invoice factoring enhances credit management. It enables firms to shift the responsibility of collecting from their shoulders to the factoring company. This results in improved customer relationships as clients deal with a dedicated team.

Additionally, using these services provides flexibility during seasonal fluctuations or unexpected expenses. Companies can scale their financing according to needs without taking on debt obligations.

Faster cash flow through invoice factoring means greater opportunities for reinvestment and expansion strategies that will drive business success in the future.

How Invoice Factoring Works

Invoice factoring works by converting outstanding invoices into immediate cash. When a business sells goods or services, it often waits for customers to pay their bills, creating cash flow challenges.

With invoice factoring, you sell these unpaid invoices to a factoring company at a discount. The factor then takes on the responsibility of collecting payments from your clients.

Once you submit your invoices, the factor typically advances 70-90% of the total amount immediately. This advance provides quick access to funds that can be used for operational expenses or growth initiatives.

When your client pays the invoice, the factoring company releases the remaining balance minus their fee. This process allows businesses to maintain steady cash flow without debt or sacrificing equity.

It’s an efficient way to manage finances while focusing on growth and customer relationships.

Choosing the Right Invoice Factoring Company

Selecting the proper invoice factoring company can significantly impact your business’s cash flow. Start by researching potential providers in depth. Look for companies with a solid reputation and years of experience.

Evaluate their terms carefully. Different companies offer varying rates, fees, and advance percentages. A lower rate might seem appealing, but hidden costs could affect your profits.

Consider customer service, too. You want a partner who is responsive and understands your needs. Check online reviews to gauge client satisfaction.

Don’t Remember flexibility. Some businesses face fluctuating demands; choose a provider that can adapt to those changes without hassle.

Ask for references from other clients within your industry. Real-world experiences provide valuable insights into what you can expect when working together on invoice factoring services.

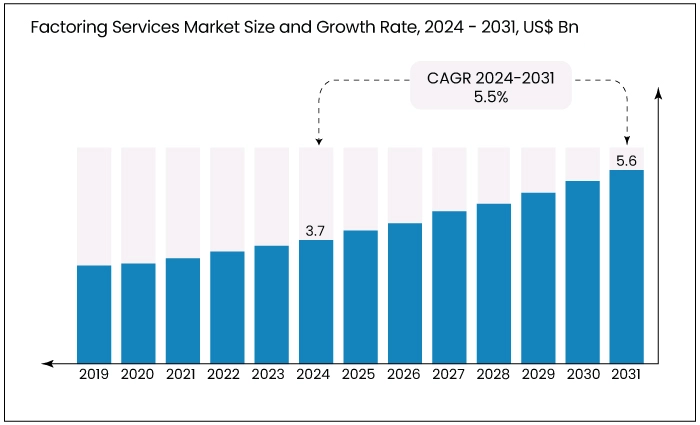

Invoice Factoring Services Market Size Forecast 2019-2031

The Factoring Services Market Size Forecast 2019-2031 presents an intriguing landscape as businesses increasingly turn to invoice factoring services to navigate their cash flow challenges and optimize working capital.

As the market evolves, projections indicate that the demand for these financial solutions is anticipated to rise steadily, driven by a notable uptick in small and medium-sized enterprises seeking quick liquidity without incurring deep debt.

The growth trajectory suggests that innovative technological advancements and digital platforms will enhance service accessibility, ensuring SMEs can convert unpaid invoices into immediate cash more seamlessly than ever before.

Additionally, the economic fluctuations post-pandemic has prompted companies across various sectors to reconsider traditional financing methods; this shift further fuels interest in invoice factoring services, which provide flexibility and prompt access to funds while allowing businesses to focus on core operations rather than waiting on customer payments.

The interplay of these factors paints a promising picture for stakeholders within the invoicing ecosystem, offering insights into current trends and potential opportunities more than a decade ahead.

Conclusion: Is Invoice Factoring Right for Your Business?

Evaluating invoice factoring for your business involves considering your unique needs and circumstances. If you’re facing cash flow challenges or need quick funds access, this financing option can provide significant relief. It allows you to improve liquidity without incurring debt.

Consider the costs associated with various providers. While some companies may charge higher fees, others offer competitive rates that align better with your budget. Additionally, think about how quickly you need access to funds and the reliability of a potential factoring partner.

Invoice factoring services can be game changers for many businesses—especially those in industries like construction, manufacturing, or freight. They stabilize cash flow and enable growth by allowing you to reinvest in operations immediately rather than waiting on customer payments.

It’s about finding what works best for your situation. Thoroughly research different options and weigh their benefits against any drawbacks they might present for your financial strategy.