Managing cash flow can feel like a juggling act in the fast-paced construction world. Delays in client payments or unexpected expenses can create significant stress for contractors and project managers.

Enter construction factoring—a financial solution gaining traction among builders looking to stabilize their finances and keep projects on track. By converting unpaid invoices into immediate working capital, construction factoring is not just a lifeline; it’s a game changer.

If you’re exploring options to enhance your project’s financial health, understanding how construction factoring works could be your next step toward success. Let’s dive deeper into this innovative financing strategy and discover how it can transform your approach to funding projects efficiently and effectively.

Benefits of Construction Factoring

Construction factoring offers immediate cash flow. This allows contractors to pay suppliers and workers on time, keeping projects on track.

It reduces waiting periods for invoice payments. You can access funds once your invoices are submitted rather than waiting 30, 60, or even 90 days.

This financial boost enhances creditworthiness. A steady cash flow means better relationships with vendors and subcontractors who appreciate timely payments.

Moreover, it minimizes the stress associated with managing finances. With fewer worries about when money will come in, project managers can focus more on executing their work efficiently.

Additionally, construction factoring is flexible and tailored to unique business needs. You choose which invoices to factor in based on your current requirements.

It’s a straightforward process that only involves lengthy applications or collateral commitments like traditional bank loans often do.

How to Qualify for Construction Factoring

Qualifying for construction factoring is more manageable than it may seem. First, ensure your company has a steady flow of invoices from reliable clients. Lenders typically look for a proven history of completed projects and consistent payments.

Next, review your creditworthiness. While factoring companies focus more on your clients’ strengths than yours, having a solid credit profile can still work in your favor.

Documentation is key. To demonstrate the validity of your receivables, you’ll need to present contracts, invoices, and proof of project completion. Transparency matters; being upfront about potential risks can build trust with lenders.

Consider the size and scale of your business. Smaller firms might face different criteria than established enterprises with extensive portfolios. Each lender has unique requirements based on its risk appetite and market conditions.

The Process of Construction Factoring

The process of construction factoring is straightforward yet impactful. It begins with the contractor submitting invoices for completed work to a factoring company. These invoices represent money owed by clients, often tied up in lengthy payment cycles.

Once submitted, the factoring company evaluates the creditworthiness of your clients and verifies the details of your projects. This assessment helps determine the amount they will advance against those invoices.

After approval, you’ll receive an immediate cash advance—typically around 70-90% of the invoice value. This influx allows you to cover expenses like payroll and materials without delay.

Once your client pays their invoice, the factoring company releases any remaining funds to you after deducting their fees. This cycle improves cash flow and reduces the stress of waiting for payments.

Implementing Construction Factoring in Your Project Plan

Integrating construction factoring into your project plan requires a strategic approach. Begin by assessing your cash flow needs and identifying specific areas where payment delays might occur. This foresight will help you decide when to utilize factoring services.

Next, establish partnerships with reputable factoring companies. Research their terms and ensure they align with your financial goals. Clear communication about expectations is essential for a smooth collaboration.

Once you’ve chosen a factor, incorporate the process into your budgeting strategy. Consider how advances from factoring will affect overall project financials and timelines.

Training key staff on the benefits of construction factoring can also foster understanding and support within your organization. Make sure everyone involved knows how it works to avoid confusion later on.

Monitor progress closely after implementation. Regular evaluations will allow you to see how construction factoring impacts cash flow throughout the project’s duration, ensuring you’re always in control financially.

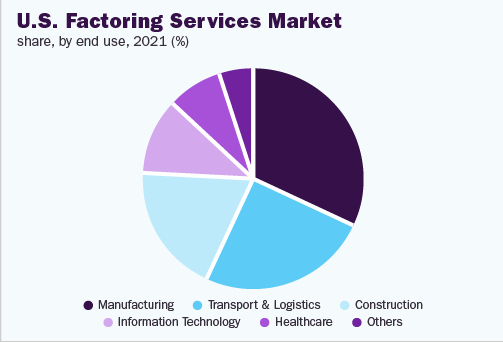

US Factoring Services Market Share 2021 by end user

In 2021, the US Factoring Services Market showcased a diverse landscape of end-user industries vying for financial solutions tailored to their unique operational demands.

The Manufacturing sector emerged as one of the most significant contributors, leveraging factoring services to address cash flow challenges and ensure seamless production cycles amid fluctuating demand.

Similarly, the Transport & Logistics industry increasingly relied on these services to manage day-to-day expenses and capitalize on timely transport contracts, driving efficiency in an unpredictable market.

Meanwhile, Construction firms turned to factoring as a strategic tool for expedited payments from clients who typically adhere to longer billing cycles; this enabled builders and contractors to maintain steady momentum in their projects without disruption.

In contrast, Information Technology companies harnessed factoring not only for immediate liquidity but also to fund innovation and swiftly scale operations in a competitive digital landscape.

Healthcare providers easily navigated complex payment structures by utilizing factoring services that facilitated quicker reimbursements from insurers while managing rising operational costs effectively.

Other sectors—collectively categorized under “Others”—also sought customized financing solutions that suited niche markets or emerging business models within evolving economic frameworks.

Conclusion

Construction factoring presents a compelling solution for managing your construction project’s financial health. This financing method enhances cash flow and allows you to focus on what truly matters—completing projects on time and within budget.

Understanding the benefits and processes can help you effectively integrate construction factoring into your financial strategy. This approach offers significant advantages, whether you’re navigating complex projects or simply need more flexibility in managing expenses.

Embracing construction factoring could be the key to unlocking smoother operations and greater profitability for your business. If you are considering its application in upcoming projects, please take the necessary steps to qualify and implement it wisely. Your project’s success might depend on the strength of its financial foundation.