The construction industry is vibrant and dynamic, brimming with potential, but often plagued by cash flow challenges. Delayed payments from clients can stifle progress and hinder project success. Enter construction factoring, a financial solution that can transform contractors’ finances. This innovative approach allows businesses to unlock the cash in unpaid invoices, providing immediate funds for materials, labor, and other essential expenses.

Imagine keeping your projects on track without having to wait weeks or even months for payment. With construction factoring, this dream becomes reality. It empowers contractors to stay ahead of schedules while maintaining operational efficiency.

Let’s dive deeper into how this game-changing strategy can fuel your project success and revolutionize how you think about construction financing.

Benefits of Construction Factoring

Construction factoring offers immediate cash flow relief for contractors. When project delays stretch payment timelines, it can strain resources. With factoring, businesses receive funds quickly, allowing them to meet payroll and cover materials without stress.

Another benefit is improved budgeting capabilities. By converting invoices into cash upfront, companies can better plan their expenditures and avoid unexpected financial shortfalls.

Additionally, construction factoring helps mitigate the risk of bad debts. Factors typically assess the creditworthiness of clients before purchasing invoices. This evaluation means contractors are less likely to face losses from unpaid bills.

This financing option fosters growth opportunities. With reliable cash flow, businesses can take on additional projects or invest in new equipment, leading to enhanced productivity and profitability over time.

How Construction Factoring Works

Construction factoring is a financial solution designed specifically for the construction industry. It allows contractors to receive immediate cash by selling their unpaid invoices to a third-party financial institution, known as a factor.

When your complete work on a project, you typically send an invoice to your client. However, waiting for payment can strain your cash flow significantly. This is where factoring comes in.

Once you submit your invoice to the factor, they assess the validity and creditworthiness of your client. Upon approval, you’ll receive a significant percentage of that upfront invoice—often around 70-90%.

The factor then takes over collecting payments from your clients when they’re due. Once paid, they will release the remaining balance minus their fees to you. This process ensures consistent cash flow and lets contractors focus on completing projects instead of chasing payments.

Factors to Consider When Choosing a Construction Factor

Several vital elements come into play when selecting a construction factor. First, evaluate their experience in the construction sector. Familiarity with industry nuances can streamline your financing process.

Next, consider their fees and terms. Transparent pricing is essential to avoid unpleasant surprises later on. Compare offers from different factors to ensure you’re getting the best deal.

Customer service quality should also be high on your list. A responsive team can make all the difference when urgent issues arise, or you need quick answers.

Additionally, look for flexibility in funding options. At other times, different projects may require varying amounts of capital.

Before making a decision, check reviews and testimonials from other contractors who have used their services. Positive feedback often indicates reliability and firm performance in real-world situations.

Tips for Maximizing the Benefits of Construction Factoring

Clarity is key to truly harnessing the power of construction factoring. Ensure your invoices are accurate and detailed, which minimizes potential delays in receiving funds.

Next, maintain open communication with your factor. Share project timelines and payment schedules to align expectations. A collaborative approach can foster stronger relationships.

Consider leveraging technology. Use accounting software that integrates seamlessly with factoring services to track and manage invoices more easily.

Always review multiple factors before making a choice. Each has unique terms, fees, and services that could significantly impact your cash flow.

Keep an eye on industry trends. Understanding market dynamics helps you make informed decisions about when to utilize factoring most effectively for optimal results in funding projects.

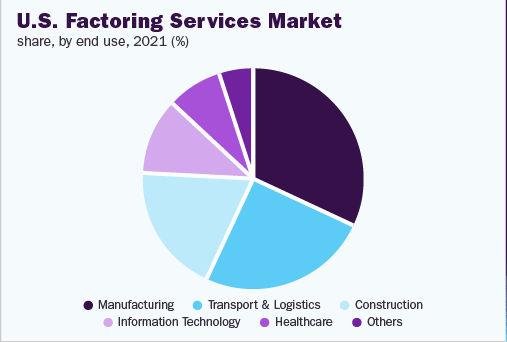

U.S. Factoring Services Market Share 2021 by End User

In 2021, the U.S. factoring services market demonstrated a diverse landscape shaped by various end users, each playing a pivotal role in its expansion. The manufacturing sector emerged as a significant player, utilizing factoring solutions to maintain liquidity and manage cash flow amidst fluctuating demand.

Similarly, logistics and transport companies turned to these services to streamline operations and secure timely client payments, ensuring efficient supply chain management. The construction industry also capitalized on factoring arrangements to mitigate the financial pressures of ongoing projects and labor costs, thereby retaining their competitive edge.

Meanwhile, businesses in information technology found innovative ways to leverage factoring for funding evolving tech needs without stifling growth due to administrative delays in receivables. The healthcare sector sought out factoring as a lifeline for managing invoices related to patient care, and insurance claims processing amid increasing operational complexities.

Additionally, numerous other industries explored tailored factoring solutions that catered explicitly to unique challenges within their fields—highlighting an overall trend toward enhanced financial flexibility across the board in this dynamic marketplace.

Conclusion: The Future of Construction Factoring and Its Impact on the Industry

The construction landscape is evolving rapidly, and so are the financial solutions that support it. Construction factoring stands out as a powerful tool for contractors and subcontractors alike.

As project demands increase, access to cash flow becomes critical. This financing method provides immediate funds and allows businesses to focus on growth rather than waiting for payments.

Construction factoring is likely to become more integrated into industry practices. Its ability to smooth out cash flow challenges will attract new players and innovative approaches within the sector. Companies that embrace this solution may find themselves better positioned in an increasingly competitive market.

As technology advances, we can expect improvements in how factoring services operate—making them even more efficient and accessible. The future promises a shift where construction factoring could be a standard practice rather than an alternative option.

In navigating these changes, firms must remain informed about their choices regarding financing options like construction factoring. Those who adapt quickly can leverage its benefits effectively, propelling their projects toward success while enhancing overall business performance in the ever-demanding world of construction finance.