Managing cash flow can be one of the biggest challenges for small contractors, significantly when client payments are delayed.

Construction factoring provides a valuable financial solution by converting outstanding invoices into immediate funds, allowing contractors to maintain steady cash flow and continue their projects smoothly.

This option primarily benefits smaller firms needing more capital reserves to cover project costs while waiting for client payments.

Let’s explore how construction factoring can empower small contractors, helping them achieve stability, efficiency, and growth.

Maintain a Steady Cash Flow to Keep Projects on Schedule

One of the primary benefits of construction factoring is its ability to provide contractors with a consistent cash flow, ensuring that projects stay on track.

Many small contractors must receive payments for completed work, which can lead to stalled projects, delayed schedules, and missed opportunities.

With construction factoring, contractors can convert their pending invoices into immediate cash, allowing them to meet project deadlines and maintain a smooth workflow without interruptions.

By removing the uncertainty of client payment schedules, construction factoring allows contractors to focus on completing projects efficiently.

A steady cash flow enables contractors to pay suppliers on time, meet payroll obligations, and cover ongoing expenses, creating a stable environment for the team and clients.

For contractors, maintaining a steady cash flow through construction factoring improves productivity and boosts client satisfaction by ensuring that projects are completed on time.

Eliminate Payment Delays with Fast Access to Funds

Payment delays are common in the construction industry, with many contractors waiting weeks or months to pay for completed work.

Construction factoring offers a solution by providing fast access to funds, bypassing the lengthy client payment process.

Instead of waiting for client checks to arrive, contractors can receive immediate funds from a factoring company, which purchases the invoices at a discounted rate and provides the contractor with the cash they need.

This fast access to capital is invaluable for contractors who rely on timely payments to keep their business operations running smoothly.

This reliability enables them to take on new projects, invest in equipment, and make timely payments to vendors without worrying about cash shortages due to delayed payments.

Secure the Resources You Need Without Taking on Debt

Unlike traditional loans, construction factoring provides financing without adding debt to a contractor’s balance sheet.

Factoring is a form of accounts receivable financing, meaning contractors receive funds based on the value of their unpaid invoices.

Since factoring isn’t considered a loan, it doesn’t affect the contractor’s credit rating or lead to additional debt obligations.

Factoring is an innovative and flexible option for small contractors looking to access funds without taking on debt options.

This debt-free financing method allows contractors to focus on growing their business without worrying about loan repayments, interest rates, or collateral requirements.

Additionally, construction factoring is accessible to companies that may not qualify for traditional bank loans, making it an ideal choice for small contractors who need working capital to manage cash flow without the burden of conventional financing.

Contractors can secure the necessary resources with construction factoring while keeping their balance sheets debt-free.

Expand Your Business Opportunities and Take on Larger Projects

Construction factoring can also open doors to new business opportunities by providing the cash flow needed for more extensive or additional projects.

Small contractors often need help scaling their operations, as they may need more funds to bid on larger projects or expand their workforce.

By using factoring, contractors gain the financial flexibility to grow their business without waiting for client payments, enabling them to pursue more significant opportunities confidently.

With a reliable source of working capital, contractors can hire additional labour, invest in quality materials, and cover upfront project costs, making it easier to scale their business and secure more contracts.

This growth potential allows contractors to increase revenue, improve their industry reputation, and gain a competitive advantage.

Construction factoring, therefore, is a valuable tool for small contractors who want to expand their operations and take on larger projects without worrying about cash flow limitations.

Simplify Cash Flow Management and Reduce Financial Stress

Managing cash flow is one of the biggest challenges in the construction industry, and small contractors often face added stress when trying to cover expenses while waiting for payments.

Construction factoring simplifies cash flow management by providing immediate funds when needed, removing the guesswork and financial strain associated with client payment delays.

Contractors can focus on their core business activities with a factoring service handling cash flow without worrying about cash shortages.

This stress-free approach to financing allows contractors to prioritize project success, customer satisfaction, and business growth.

When contractors don’t have to worry about cash flow, they can plan more effectively, make timely payments, and ensure that every aspect of their project runs smoothly.

Construction factoring thus serves as a valuable solution for small contractors seeking more excellent financial stability and less stress in managing their day-to-day operations.

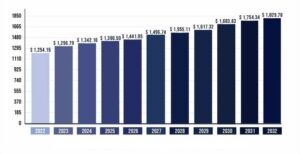

Global Construction Factoring Services Market Size Forecast 2022-2032

The global construction factoring services market is expected to grow steadily from 2022 to 2032, driven by increasing demand for financial solutions that address cash flow challenges in the construction industry.

Small and medium-sized contractors, in particular, are increasingly turning to factoring services to manage working capital and sustain operations without waiting for lengthy client payment cycles.

Construction factoring allows contractors to leverage outstanding invoices for immediate funding, supporting day-to-day expenses, payroll, and project expansion.

As construction projects grow in complexity and scale, the need for reliable cash flow becomes more critical, with factoring services providing a flexible solution to meet financial demands.

Additionally, the rise of digital platforms and streamlined application processes make factoring more accessible, allowing companies to secure funds to stay competitive quickly.

With the construction industry’s ongoing expansion, the construction factoring market is well-positioned for long-term growth as it meets the financial needs of contractors.

Conclusion: Achieve Financial Freedom with Construction Factoring

Construction factoring offers small contractors an effective way to overcome cash flow challenges, providing the financial flexibility and stability they need to succeed.

By offering quick access to working capital without adding debt, construction factoring enables contractors to manage expenses, pay employees, and take on larger projects without worrying about payment delays.

Construction factoring is an innovative and efficient solution for contractors looking to reduce financial strain and grow their business.

Embrace the benefits of construction factoring and take control of your cash flow for a more prosperous construction business.