Running a small business can feel like a juggling act. You’re constantly balancing the need for cash flow with the challenges of unpaid invoices and delayed payments. It’s frustrating. This is where small business factoring comes into play.

It offers a solution that alleviates your financial stress and propels your growth forward. Imagine having immediate access to cash instead of waiting weeks or months for clients to pay their bills. Sounds intriguing?

Let’s explore how this innovative financing option can reshape your financial landscape and help you thrive in today’s competitive market.

What is Small Business Factoring?

Small business factoring is a financial strategy that allows companies to improve cash flow. It involves selling outstanding invoices to a third party, known as a factor. This process provides immediate capital instead of waiting for customers to pay their bills.

This solution can be vital when businesses face cash flow challenges. Factors typically advance a significant percentage of the invoice amount upfront—often around 70-90%.

The remaining balance is paid once the customer settles the invoice, minus fees charged by the factor. This arrangement helps small businesses access funds quickly without taking on debt.

Many entrepreneurs find it appealing because it offers flexibility and quick access to working capital. Additionally, factoring can aid in managing operational costs or seizing new opportunities without lengthy approval processes typical of traditional loans.

How Small Business Factoring Works

Small business factoring is a straightforward process that offers immediate cash flow relief. It begins when a business sells its outstanding invoices to a factoring company at a discount.

Once the agreement is in place, the factor typically advances 70% to 90% of the invoice value upfront. This quick infusion of cash can help cover operational costs or seize new opportunities without waiting for customers to pay their bills.

After your customers settle their invoices, the factoring company releases the remaining balance minus their fee. This structure allows businesses to maintain steady operations and manage growth effectively.

Unlike traditional loans, small business factoring doesn’t require collateral or extensive credit checks. It’s based on the strength of your receivables rather than your credit score, making it accessible for many small enterprises seeking liquidity fast.

Benefits of Factoring for Small Businesses

Small business factoring offers immediate financial relief. By converting unpaid invoices into cash, companies can access funds without waiting for clients to pay.

This speedy influx of capital allows businesses to meet urgent expenses like payroll and inventory. It reduces the stress of cash flow gaps, enabling owners to focus on growth rather than chasing payments.

Factoring also eliminates the burden of debt. Unlike loans, it doesn’t require collateral or long-term commitments. This flexibility makes it an attractive option for many entrepreneurs.

Another advantage is improved credit management. Factoring companies often handle collections, which means small businesses can spend less time on administrative tasks and more on their core operations.

Moreover, factoring can enhance your company’s credibility by ensuring timely supplier payments. Reliable cash flow fosters stronger relationships and may lead to better negotiation terms in the future.

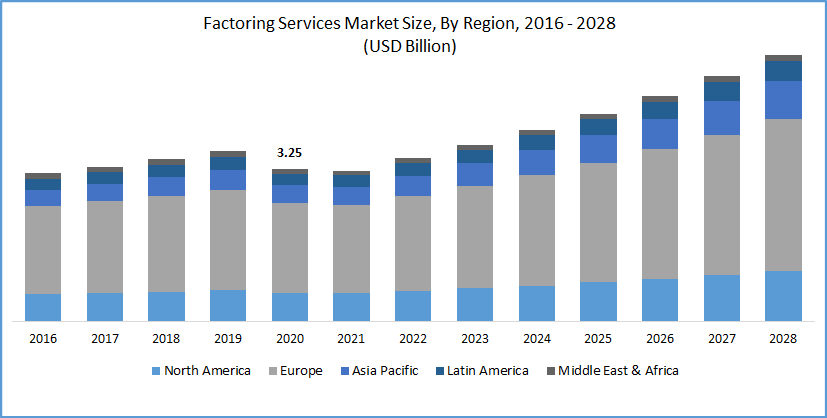

Factoring Service Market Size Forecast 2016-2028 by region

The factoring service market size forecast from 2016 to 2028 illustrates a dynamic landscape shaped by regional developments across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

A steady demand for liquidity solutions among small and medium-sized enterprises has fueled significant growth in North America. At the same time, Europe’s mature financial infrastructure continues to innovate with technology-driven factoring services.

Meanwhile, in Asia Pacific, rapid industrialization and an expanding SME sector propel the adoption of factoring as businesses seek alternatives to traditional bank financing. The vibrant markets in Latin America are also emerging as key players due to increasing awareness of factoring benefits amidst economic fluctuations.

In contrast, the Middle East & Africa present unique challenges and opportunities; here, the burgeoning entrepreneurial spirit coexists with regulatory hurdles that could shape future service offerings in this diverse region.

Collectively, these trends reflect how distinct regional characteristics influence the overall trajectory of the global factoring service market over the forecast period.

Conclusion: Is Factoring Right for Your Business?

Evaluating your specific financial situation and operational needs is essential when considering whether small business factoring is the right choice for your company.

Factoring can provide immediate cash flow relief, allowing you to invest in growth opportunities or meet urgent expenses.

However, it’s not a one-size-fits-all solution. The costs associated with factoring can vary based on factors like your industry and the volume of invoices you have. Small businesses should weigh these costs against the benefits of improved liquidity.

Consider how quickly you need access to funds and whether waiting for customers to pay aligns with your cash flow strategy. Factoring could be a game-changer for some businesses, especially those facing seasonal fluctuations or rapid growth demands.

By understanding its mechanics and assessing its fit within your financial framework, you can make an informed decision that supports your long-term goals.